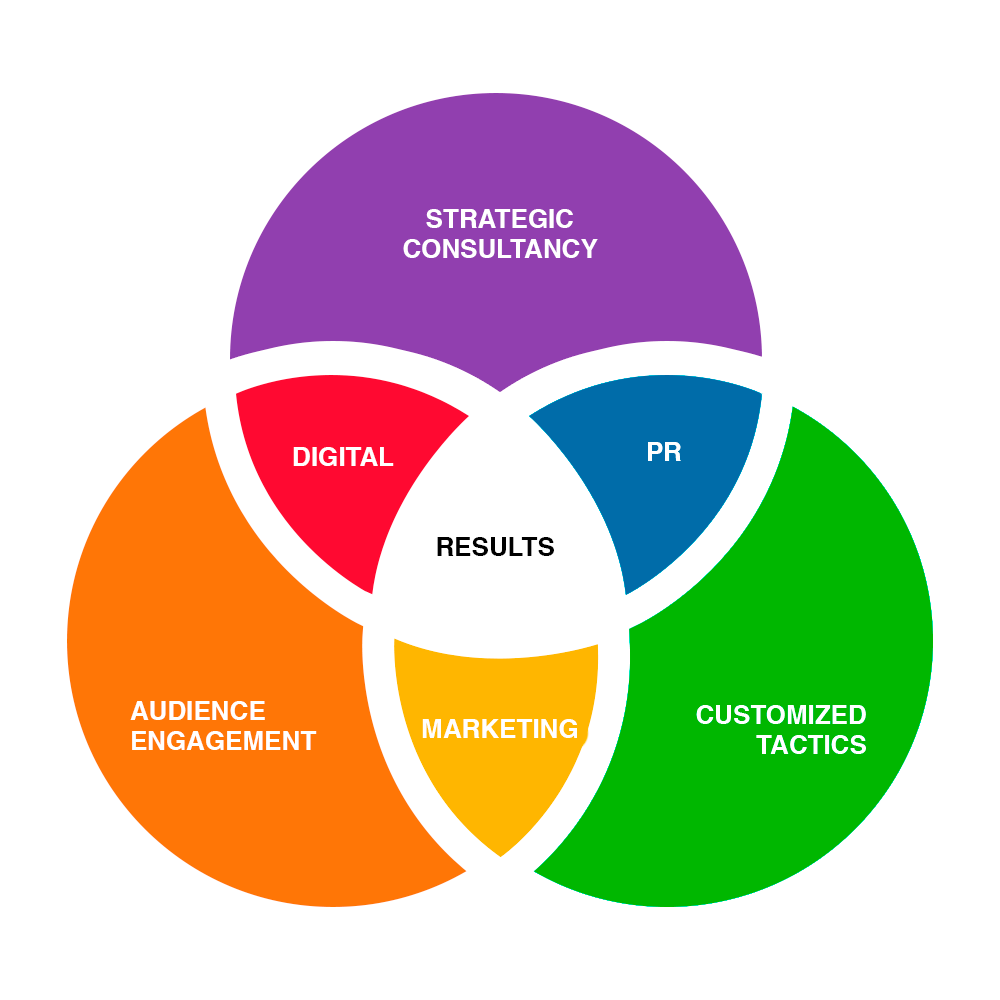

We are always looking at strategic and tactical ways to building identity, reputation, credibility and awareness for our clients so that they enjoy preference, trust and advocacy. Our strategies have a track record of delivering tangible results from contributing to sales to enhancing a company’s market value.

Instead of having to hire multiple agencies to achieve your marketing and communications goals, PR Global’s customers often buy integrated communications and marketing packages. We often provide media relations, social media, videos, marketing and events all in the same annual program.

ESG matters to us at PR Global. It is more than a passion. It is the future for our children. This is why we love helping clients tell their sustainability story worldwide. From the UN’s High Level Dialogue on Energy to Edinburgh’s COP26, we are showing how our clients put ESG first.

The PR’s team was responsible for all media interactions of the “FT Commodities Americas”, summit organized by the British newspaper Financial Times, held in Rio de Janeiro. The event was covered by media like Reuters, Agência Estado, Agência EFE, Bloomberg, Jornal Nacional (TV Globo), Folha de S. Paulo, G1, Valor Econômico, Fast Markets, O Globo, Veja RJ, Band News, CBN and Radio O Globo. A total of 82 million potential readers were reached and over R$1.4 million in Advertising Equivalent Value.